CALIFORNIA MORTGAGE RELIEF PROGRAM EXPANDS ELIGIBILITY REQUIREMENTS FOR HOMEOWNERS WHO EXPERIENCE PANDEMIC-RELATED FINANCIAL HARDSHIPS

The California Mortgage Relief Program has significantly expanded eligibility requirements to offer funding to a greater number of California homeowners who have fallen behind on housing payments due to the impact of the COVID-19 pandemic. The program has modified the past-due requirement to include homeowners who missed payments in the first half of 2022, expanded the income eligibility and will now cover past-due property taxes for more homeowners.

“Many California homeowners, like many renters, felt the impact of COVID-19 on their household Finances, putting them at risk of losing the homes they’ve worked so hard for,” said Secretary of the California Business, Consumer Services and Housing Agency Lourdes Castro Ramírez. “I’m proud of the partnership with the U.S. Treasury providing $1 billion for the California Mortgage Relief Program

and I applaud the California Housing Finance Agency for removing barriers to participating and providing greater program flexibility to assist more California homeowners struggling to stay in their homes.”

The California Mortgage Relief Program has expanded eligibility to homeowners who missed mortgage payments in 2022.

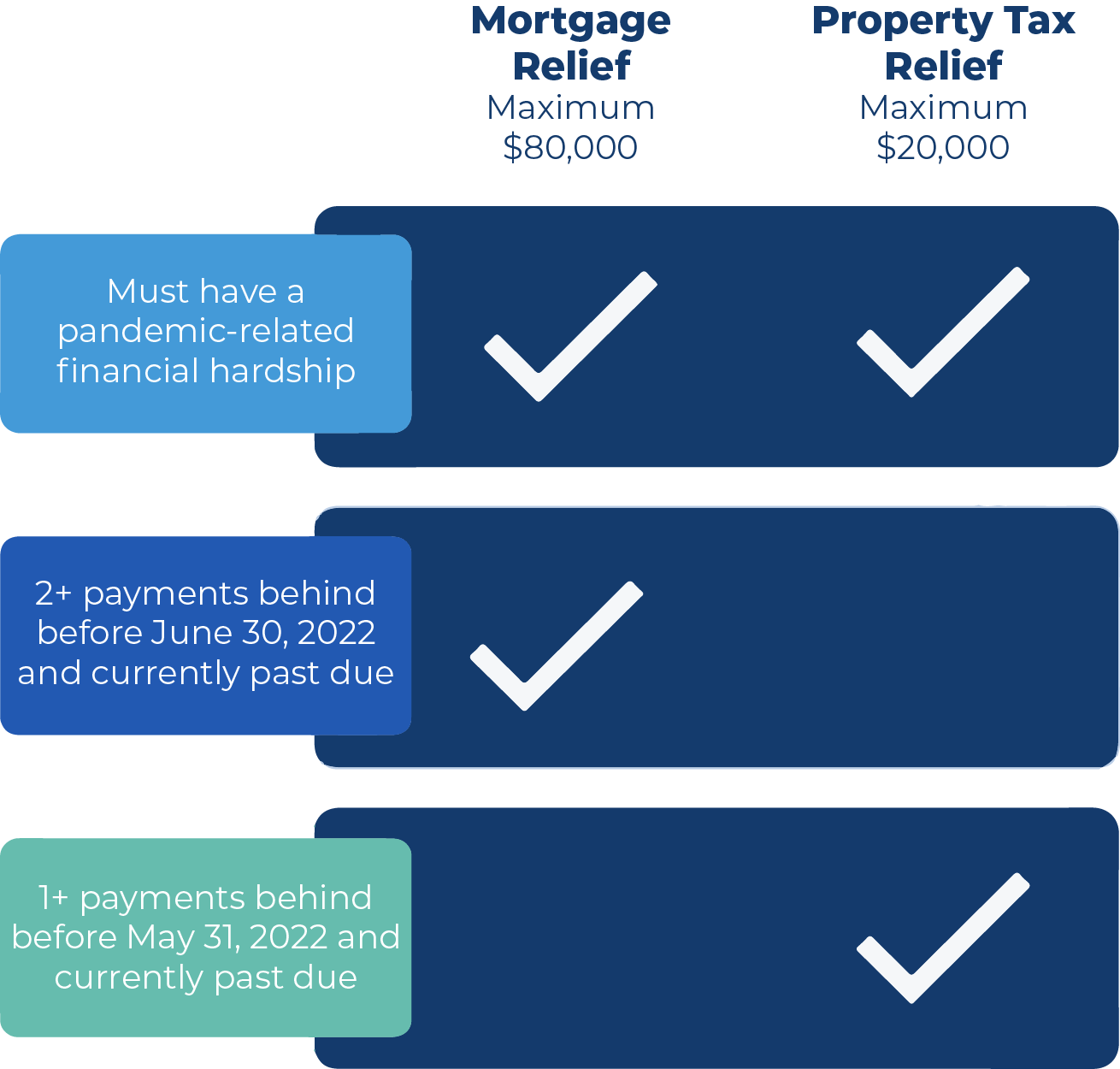

With this change, homeowners who missed at least two payments before June 30, 2022, and are currently delinquent, may now be eligible for full reimbursement for missed housing payments up to $80,000. Previously, program criteria required homeowners to miss at least two payments prior to program launch on December 27, 2021.

The program has also adjusted the income threshold for program qualification. Homeowners are now eligible for assistance from the program if their household income is at or below 150% of their county’s Area Median Income (based on ederal limits established by HUD for the program)

What is the California Mortgage Relief Program?

The California Mortgage Relief Program uses federal Homeowner Assistance Funds to help homeowners get caught up on past-due housing payments and property taxes. The program is absolutely free and the funds do not need to be repaid.

The program is absolutely free and the funds do not need to be repaid. The program is open to all eligible Californians who are currently experiencing pandemic-related hardships and have fallen behind on their housing payments.

Eligible applicants must be at or below 100% of their county’s Area Median Income, own a single-family home, condo or permanently affixed manufactured home and have faced a pandemic-related financial hardship after January 21, 2020, and also meet at least one of the following qualifications: Receiving public assistance; Severely housing burdened; or have no alternative mortgage workout options through your mortgage servicer.

Applicants must meet the eligibility criteria outlined below in order to qualify for program assistance. The U.S. Treasury-approved term sheets can be found here.

Applicants who do not meet the criteria below should contact a HUD-certified housing counselor to explore other options that may be available. Click here to find a HUD-certified housing counselor near you.

ELIGIBILITY REQUIREMENTS

MORTGAGE RELIEF

Maximum grant amount

$80,000

Must meet

ALL requirements

PROPERTY TAX RELIEF

Maximum grant amount

$20,000

Must meet

ALL requirements

THE BASICS:

Must have faced a Qualified Financial Hardship due to COVID-19 after January 21, 2020.

*The attestation must describe the nature of the financial hardship.

For mortgage relief, homeowner’s mortgage/loan servicer must be participating in the California Mortgage Relief Program.

A list of participating mortgage servicers can be found here.

Eligibility Requirements

Whether they have a mortgage, a reverse mortgage, or are mortgage-free, the program can help homeowners with past-due housing payments.

For more details on eligibility visit Who is Eligible.

How to Apply

If you think you might be eligible for the program, click here to check your eligibility and apply.

If you need assistance with your application or have questions about your eligibility, please contact your mortgage servicer or a HUD-certified housing counselor at 1-800-569-4287.

Find a HUD-Certified Housing Counselor Near You.

If you’re behind on your mortgage, don’t panic!

Even if the foreclosure process has started, it can often take several months before your home is foreclosed. You may still have time to seek help.

To learn more about the foreclosure process, visit California’s Housing Is Key website.HOUSING IS KEY