Your Housing Perspective

The housing market is slowing with sales declining and home prices softening. Home sales in California dropped 31.1% year- over-year in July 2022 and last month was the third consecutive month with sales falling more than 10% from a year ago.

Prices also began to moderate in the past couple months after the statewide median price set a record high in May. The July median price of $833,910 in California was the lowest in five months and the less than 3% year-over-year growth rate was the smallest gain in the past 25 months. With rates rising and the economy slowing, the downward shift in the housing market will continue as the year approaches its holiday season.

Housing supply has been on the rise but will level off in the fall of 2022 as seasonality kicks in. Inventory will be at a level higher than what it was a year ago, but supply for the rest of the year will remain below the norm by historical standards. In addition, mortgage market fundamentals are much better than what they were during the 2008 financial crisis, which will help prevent another foreclosure crisis. As such, tight supply market conditions will continue to provide support to keep housing values from falling too fast.

With more sellers reducing their prices in recent months, some buyers may delay their home buying decision until next year as they wait for prices to fall further. While the price of a property is an important variable to consider when buying a home, interest rates should be an equally important factor to take into consideration when buying a property with a home loan.

Mortgage rates are near their highest level in almost 14 years and will likely climb further as inflation remains elevated. The average 30-year fixed rate mortgage could rise above 6.5% by the year-end and could inch up closer to 7% by mid-2023.

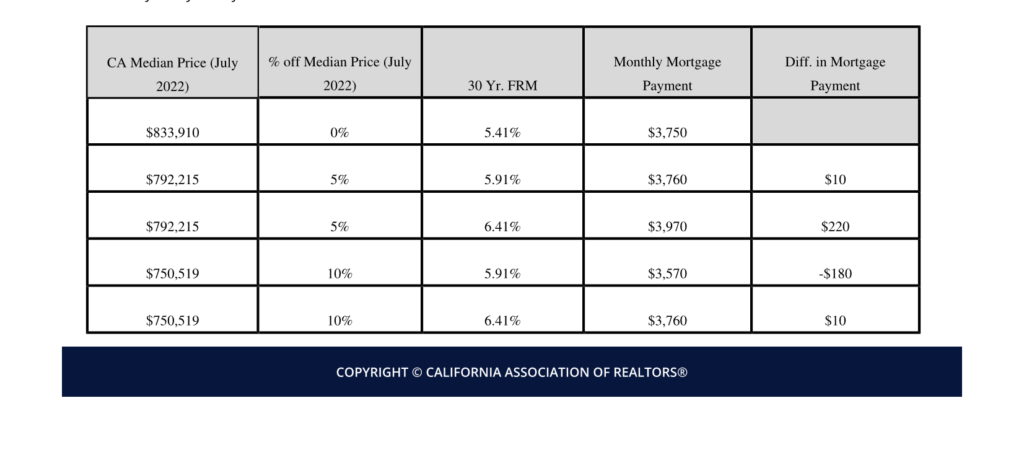

Buyers waiting for prices to fall could end up paying more on their monthly mortgage payment because of the higher interest rates. For example, a buyer who purchased a median-priced home and financed it at the July’s prevailing 30-year fixed-rate of 5.41% with a 20% down payment would have a mortgage payment of $3,750.

If the buyer were to wait and purchase the same property next year with a price drop of 10% and finance it with a 30-year fixed-rate that is one percentage point higher than today’s rate, the mortgage payment would turn out to be $10 higher.

With prices not expected to drop low enough to offset a higher interest rate, it may not be a good idea for buyers to wait until next year if they find a property that they like and are financially ready to buy.