Real estate investment trusts (“REITs”) have been around for more than fifty years. Congress established REITs in 1960 to allow individual investors to invest in large-scale, income-producing real estate. REITs provide a way for individual investors to earn a share of the income produced through commercial real estate ownership – without actually having to go out and buy commercial real estate.

What is a REIT?

A REIT, generally, is a company that owns – and typically operates – income-producing real estate or real estate-related assets. The income-producing real estate assets owned by a REIT may include office buildings, shopping malls, apartments, hotels, resorts, self-storage facilities, warehouses, and mortgages or loans. Most REITs specialize in a single type of real estate – for example, apartment communities.

There are retail REITs, office REITs, residential REITs, healthcare REITs, and industrial REITs, to name a few. What distinguishes REITs from other real estate companies is that a REIT must acquire and develop its real estate properties primarily to operate them as part of its own investment portfolio, as opposed to reselling those properties after they have been developed.

How to Qualify as a REIT?

To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends. A company that qualifies as a REIT is allowed to deduct from its corporate taxable income all of the dividends that it pays out to its shareholders. Because of this special tax treatment, most REITs pay out at least 100 percent of their taxable income to their shareholders and, therefore, owe no corporate tax.

In addition to paying out at least 90 percent of its taxable income annually in the form of shareholder dividends, a REIT must:

•Be an entity that would be taxable as a corporation but for its REIT status;

•Be managed by a board of directors or trustees; •Have shares that are fully transferable;

•Have a minimum of 100 shareholders after its f irst year as a REIT;

•Have no more than 50 percent of its shares held by five or fewer individuals during the last half of the taxable year; •Invest at least 75 percent of its total assets in real estate assets and cash;

•Derive at least 75 percent of its gross income from real estate related sources, including rents from real property and interest on mortgages financing real property;

•Derive at least 95 percent of its gross income from such real estate sources and dividends or interest from any source; and

•Have no more than 25 percent of its assets consist of non-qualifying securities or stock in taxable REIT subsidiaries

Three Categories of REITs:

Equity, Mortgage, and HybridREITs generally fall into three categories: equity REITs, mortgage REITs, and hybrid REITs. Most REITs are equity REITs. Equity REITs typically own and operate income-producing real estate. Mortgage REITs, on the other hand, provide money to real estate owners and operators either directly in the form of mortgages or other types of real estate loans, or indirectly through the acquisition of mortgage-backed securities. Mortgage REITs tend to be more leveraged (that is, they use a lot of borrowed capital) than equity REITs. In addition, many mortgage REITs manage their interest rate and credit risks through the use of derivatives and other hedging techniques. You should understand the risks of these strategies before deciding to invest in these types of REITs. Hybrid REITs generally are companies that use the investment strategies of both equity REITs and mortgage REITs.

Because they often invest in debt securities secured by residential and commercial mortgages, mortgage REITs can be similar to certain investment companies that are focused on real estate. Generally, companies that invest a majority of their assets in real estate are exempted from the rules that govern investment companies, such as mutual funds. The SEC has initiated a review to determine whether certain mortgage REITs should continue to be exempt from investment company regulation. Those rules generally limit the amount of leverage that a fund can use and regulate the fees that can be charged to investors.

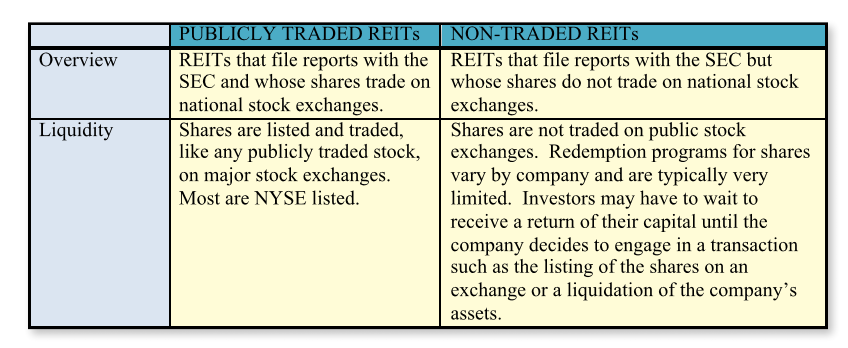

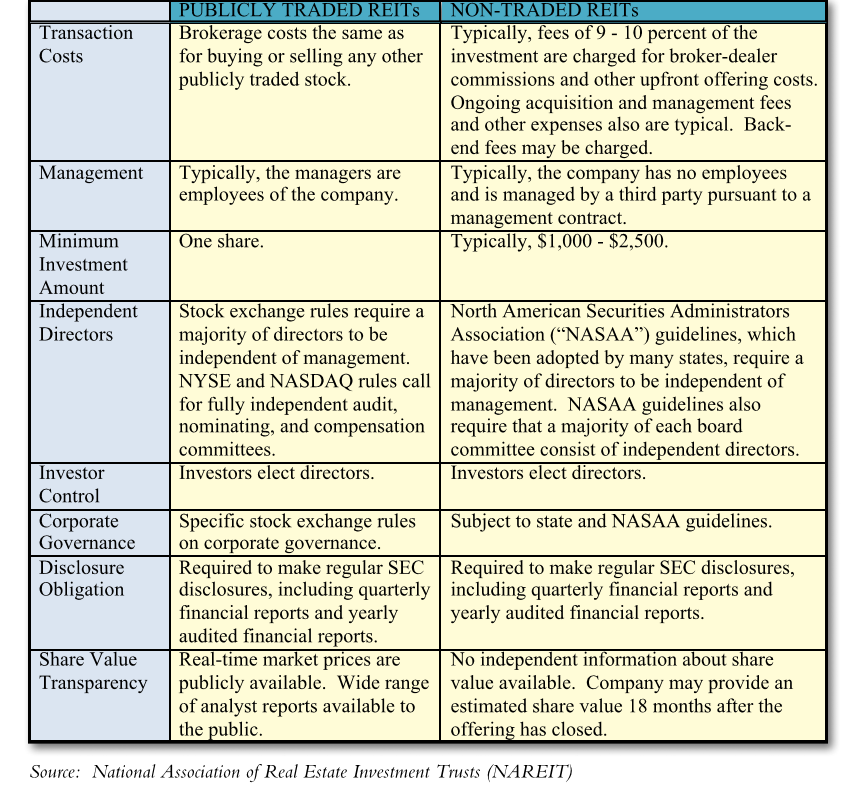

Comparison of Publicly Traded REITs and Non-Traded REITs

Many REITs (whether equity or mortgage) are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. In addition, there are REITs that are registered with the SEC, but are not publicly traded. These are known as non-traded REITs (also known as non-exchange traded REITs). The table below compares the characteristics of publicly traded and non-traded REITs.

Some Caveats about Non-Traded REITs

• Lack of Liquidity:

Non-traded REITs are illiquid investments; they generally cannot be sold readily on the open market. If you need to sell an asset to raise money quickly, you may not be able to do so with shares of a non-traded REIT. Although non-traded REITs usually offer share redemption programs, these are typically subject to significant limitations and may be discontinued at the discretion of the company. Investors may have to wait to receive a return of their capital until the company decides to engage in a transaction such as the listing of the company’s assets. The Timing of these liquidity events is at the discretion of the company. and may be more than 10 years after the investment is made.

• Share of Value Transparency.

While the market price of a publicly traded REIT is readily accessible, it can be difficult to determine the value of a share of a non-traded REIT. Because non-traded REITS are not traded on an exchange there is no market rice available. Non-Traded REITs typically do not provide an estimate of their value per share until 18 months after their offering closes, but this may be years after you have made your

investment. As a result, you may not be able to assess the value of your non-traded REIT investment for a significant time period and may not be able to assess the volatility of your investment.

• Significant Up-Front Fees:

Non-traded REITs are typically sold by financial advisers. Non-traded REITs generally have high upfront fees that lower the value of the investment by a significant amount. They usually charge sales commissions and upfront offering fees of approximately nine to 10 percent. Investors should understand that a portion of the share purchase price represents sales commissions and that the amount actually invested in the company is reduced by these commissions.

• Distributions May Be Paid from Offering

Proceeds and Borrowings: Investors may be attracted to non-traded REITs by their relatively high dividend yields compared to those of publicly traded REITs. However, investors should consider the total return of a non-traded REIT – capital appreciation plus dividends – instead of focusing exclusively on the high dividend yield. Unlike publicly traded REITs, non-traded REITs frequently pay distributions in excess of their funds from operations. To do so, they may use offering proceeds and borrowings. This practice, which is typically not used by publicly traded REITs, reduces the value of the shares and reduces the cash available to the company to purchase additional assets. In considering an investment in a non-traded REIT, you should assess the extent to which distributions have been paid

from sources other than funds from operation

• Conflicts of Interest:

Non-traded REITs are typically externally managed—meaning the REITs do not have their own employees.

The external manager may be paid significant fees by the REIT for things that may not necessarily be aligned with the interests of shareholders, such as fees based on the amount of property acquisitions and assets under management. In addition, the external manager may also manage other companies that may compete with the REIT

Investing in REITs

As with any investment, you should take into account your own financial situation, consult your financial adviser, and perform thorough research before making any investment decisions concerning REITs. You can review a REIT’s disclosure filings, including annual and quarterly reports and any offering prospectus at sec.gov. You can invest in a publicly traded REIT, which is listed on a major stock exchange, by purchasing shares through a broker (as you would

other publicly traded securities). Generally, you can purchase the common stock, preferred stock, or debt securities of a publicly traded REIT. You can purchase shares of a non-traded REIT through a broker that has been engaged to participate in the non-traded REIT’s offering. You can also purchase shares in a REIT mutual fund (either an index fund or actively managed fund) or REIT exchange-traded fund.

Special Tax Considerations

The shareholders of a REIT are responsible for paying taxes on the dividends that they receive and on any capital gains associated with their investment in the REIT. Dividends paid by REITs generally are treated as ordinary income and are not entitled to the reduced tax rates on other types of corporate dividends. For this reason, some investors prefer to own shares of a REIT or REIT fund inside a tax-deferred account (such as a retirement account) in order to defer paying

taxes on the dividends received and any capital gains incurred from that REIT until they start withdrawing money from the tax-deferred account. Finally, a REIT is not a pass-through entity. This means that, unlike a partnership, a REIT cannot pass any tax losses through to its investors. Consider consulting your tax adviser before investing in REITs

FINRA Investor Alert: Public Non-Traded REITs—Perform a Careful Review before Investing

The Office of Investor Education and Advocacy has provided this information as a service to investors. It is neither a legal interpretation nor a statement of SEC policy. If you have questions concerning the meaning or application of a particular law or rule, please consult with an attorney who specializes in securities law.