Pinterest

There are many reasons to pay off your mortgage early. If you aspire to enter retirement debt-free, paying off your mortgage could free up a significant amount of your fixed monthly income. Since people are living longer after they retire, it’s essential to make your money stretch. Being mortgage-free means not only avoiding that monthly payment but also saving on interest. According to Schwab, paying off your mortgage early is particularly beneficial if you have a high interest rate.

Even if you are not yet thinking about retirement, there are benefits to paying off your mortgage early. Owning your home outright means there is no fear of foreclosure, giving you peace of mind. It also offers a significant amount of equity if you ever need to borrow against your home’s value. Regardless of your reason for paying off your mortgage early, there are several simple ways to accomplish this task.

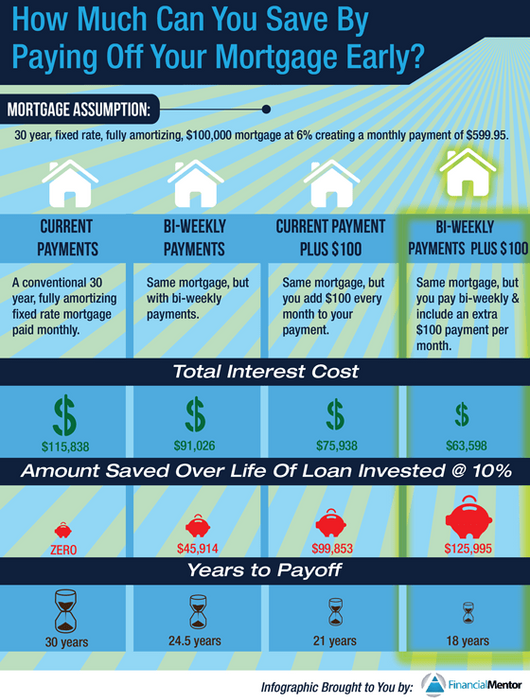

BI-WEEKLY PAYMENTS

Paying off your mortgage in biweekly payments can reduce your 30-year mortgage by up to four years and save you a significant amount of money in interest.

REGULAR EXTRA PAYMENTS

The most important thing to remember when you are making extra payments is to ensure your lender applies the entire amount to the principal of your loan instead of processing it as a regular mortgage payment.

LUMP SUM PAYMENTS

Making additional lump sum payments to the principal of your mortgage is as simple as it sounds — you simply make a payment any time you have some extra money. This type of random payment can be as small as a few hundred dollars a year.

REFINANCE

If you are paying a loan with a higher-than-average interest rate, you may benefit long-term by refinancing to pay less in interest over the life of your loan. You can also opt to change your loan terms from a 30-year loan to a 10 or 15-year loan, which may increase your monthly payments. If you can afford the higher payments, you will build equity in your home much more quickly while paying it off in half the time.

MORTGAGE RECASTING

When you choose this option to update your mortgage, you retain your current loan and mortgage provider as well as your interest rate and the term of your loan. The benefit of mortgage recasting is to lower your monthly payment, freeing up more money in your budget to pay down debt.

For more, visit HouseDigest.com